Unlocking Potential: A Deep Dive into Insurance Companies for Sale

The insurance industry has undergone remarkable transformation over the past few decades, and for aspiring entrepreneurs and seasoned investors alike, insurance companies for sale represent a unique opportunity. This article aims to not only provide you with an in-depth understanding of this lucrative market but also equip you with practical advice on how to navigate the purchasing process effectively.

Understanding the Insurance Market

Before diving into the specifics of purchasing an insurance company, it’s crucial to grasp the broader context of the insurance market. The sector is multifaceted, encompassing various types of insurance products and services tailored to meet diverse client needs. Below are key segments within the insurance industry:

- Life Insurance: Financial protection for dependents upon the policyholder's death.

- Health Insurance: Coverage for medical expenses and health-related costs.

- Property and Casualty Insurance: Protection against property loss and liability risks.

- Specialty Insurance: Coverage for niche markets or unique risks.

Each segment exhibits unique characteristics, regulatory requirements, and market dynamics, making the insurance industry a rich environment for investment.

The Advantages of Purchasing an Insurance Company

Investing in an insurance company offers numerous benefits compared to other business ventures. Here are some compelling reasons to consider:

- Steady Cash Flow: Insurance businesses typically enjoy consistent revenue streams due to regular premium payments.

- Growing Market: As the global population grows, so does the demand for insurance, providing a fertile ground for expansion.

- Diversity of Products: The ability to offer various insurance products can help mitigate risk and enhance profitability.

- Established Customer Base: Acquiring an existing company provides immediate access to a loyal client base.

Market Trends Influencing Insurance Companies for Sale

When considering insurance companies for sale, it's essential to stay informed about current market trends that may impact your investment. Some of these trends include:

1. Technological Advancements

The insurance industry is increasingly leveraging technology to improve operations, enhance customer experience, and streamline claims processing. Innovations like artificial intelligence (AI), machine learning, and big data analytics are reshaping how insurers assess risk and offer personalized policies.

2. Regulatory Changes

Insurance is heavily regulated, with frequent changes to laws and compliance requirements. Investors must stay abreast of these regulations to avoid costly violations and understand the legal landscape that governs their new business.

3. Climate Change Considerations

As climate change continues to impact risk assessments, particularly in property and casualty insurance, companies must adapt their strategies accordingly. Understanding how environmental factors influence underwriting practices is crucial for any investor.

Steps to Buy an Insurance Company

Purchasing an insurance company is not a simple process; however, with the right approach and diligence, you can navigate it successfully. Follow these vital steps:

1. Identify Your Investment Goals

Before you jump into the process, define what you want to achieve with your investment. Are you looking for immediate profits, long-term growth, or an entry point into the insurance sector? Clarifying your objectives will guide your decision-making process.

2. Conduct Market Research

Investigate available insurance companies for sale through reputable brokerage firms. Study the market conditions, competitors, and customer demographics to ensure you make an informed choice.

3. Perform Due Diligence

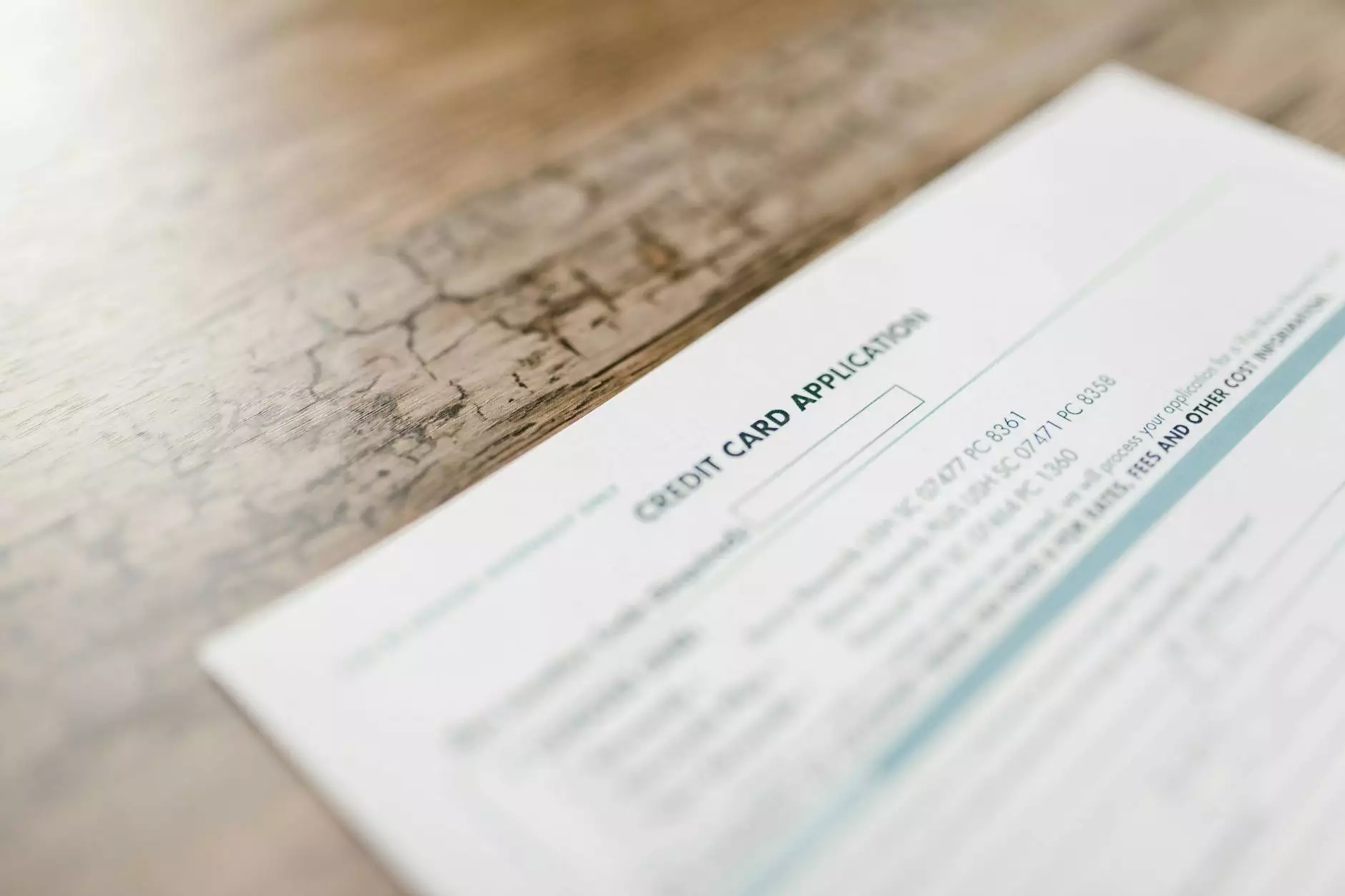

Thorough due diligence is critical. Examine financial statements, policy portfolios, claims histories, and compliance records. Consider hiring experts to assess risk exposure and operational efficiency.

4. Analyze the Business Model

Understand the company’s business model, including its revenue streams, customer acquisition strategies, and retention rates. A solid grasp of how the company operates will be crucial for your future success.

5. Negotiate and Close the Deal

Once you’re ready, engage in negotiations with the seller. Be prepared to review different offers and terms. Upon reaching an agreement, ensure all legal documents are thoroughly vetted before closing the deal.

Financial Considerations When Buying an Insurance Company

Understanding the financial aspects is crucial when purchasing an insurance company. Below are key financial indicators to consider:

- Loss Ratios: This is the ratio of claims paid out to premiums earned and indicates the company’s profitability.

- Expense Ratios: A measure of the company’s operating efficiency, revealing how much of the premium income is consumed by administrative and operational expenses.

- Combined Ratio: The sum of the loss ratio and expense ratio; a combined ratio under 100% indicates profitability.

- Reserves: Adequate reserves for future claims are essential, ensuring the insurer can meet obligations.

Post-Purchase Strategies for Insurance Companies

Once you've acquired an insurance company, implementing effective post-purchase strategies is vital for ensuring growth and sustainability. Consider the following approaches:

1. Optimize Operations

Conduct a thorough review of operational processes. Streamlining workflows, improving employee training, and investing in technology can enhance performance and customer satisfaction.

2. Enhance Marketing Efforts

Develop targeted marketing campaigns to reach potential clients. Utilize digital marketing strategies, such as social media and search engine optimization, to increase visibility in a competitive market.

3. Expand Service Offerings

Explore opportunities to diversify your product offerings. Introducing new types of insurance or customizable policies can attract a broader customer base and enhance profitability.

4. Focus on Customer Experience

A positive customer experience is crucial for retention. Implement feedback mechanisms and continuously improve service delivery based on customer insights.

Conclusion: Embrace the Opportunity

Investing in insurance companies for sale can be a rewarding venture, offering significant growth potential and sustainability in an ever-evolving market. By understanding the intricacies of the insurance industry, performing due diligence, and applying effective post-acquisition strategies, you can help ensure the success of your investment. As the industry continues to adapt to new challenges and opportunities, your proactive approach can position you favorably within this dynamic landscape.

For those looking to explore openfair.co and delve deeper into business consulting, we provide the insights and resources necessary for making informed investment decisions in the insurance sector.